Animal Fiber Producer Survey Results Now Available

Piedmont Fibershed is happy to announce that the results of The Survey of Animal Fiber Producers in North Carolina are complete and published. The full report is accessible online.

Tour of Shady Acres Farm from 2019. Photo credit Courtney Lockemer.

Piedmont Fibershed (PF) set out to better characterize the animal fiber farms of North Carolina. Between April 2023 and April 2024, PF received survey responses from 68 animal fiber farms. The study aimed to identify the following: 1. How many small-to-mid size producers there are in our region and what their scale is, 2. What infrastructure exists to process their fibers and 3.The end use of that fiber (to identify the gaps in the fiber supply chain that PF could potentially address).

The total animal fiber production in North Carolina in 2022 was estimated to be 46,000 pounds of wool and 2,300 pounds of mohair (goat fiber) by the USDA’s census of farmers. The study revealed that 60% of respondents raise sheep, 37% raise alpaca, and 20% raise angora goat. Thirty-percent of respondents reported raising multiple categories of animals. The survey respondents skewed primarily white, female, and age 60 or older.

The amount of fiber farming experience respondents had ranged widely. Two percent of respondents had less than a year of experience, 38% had 1-5 years, 25% had 5-10 years, 26% had 10-20 years, 11% had 20+ years. Only 35 percent of producers are able to process their fiber with equipment onsite. The top challenges with producing fiber were reported as Money (16%), Limited Mill Operations (15%), Time/Labor (13%), Processing Times (13%), and Transportation (10%).

CABO (Carolina Alpaca Breeders and Owners) show in February 2024. Photo credit Courtney Lockemer.

End users of the produced fiber are primarily hobbyists (45%), though many are Professional Fiber Artists (14%), and some are Wool Pool/Co-ops (11%). This survey also found that much of the produced animal fiber is not sold. Only 30% of respondents sold more than half of their annual production. When asked about key challenges with the fiber marketplace, many respondents reported not having access to an adequate marketplace to sell their fiber. This lack of marketplace was attributed to the lack of access to a venue that met their needs (large stores weren’t willing to source locally, Etsy fees were prohibitively high, etc.) as well as the lack of price competitiveness when comparing locally produced wool yarn with mass produced synthetic fiber yarns.

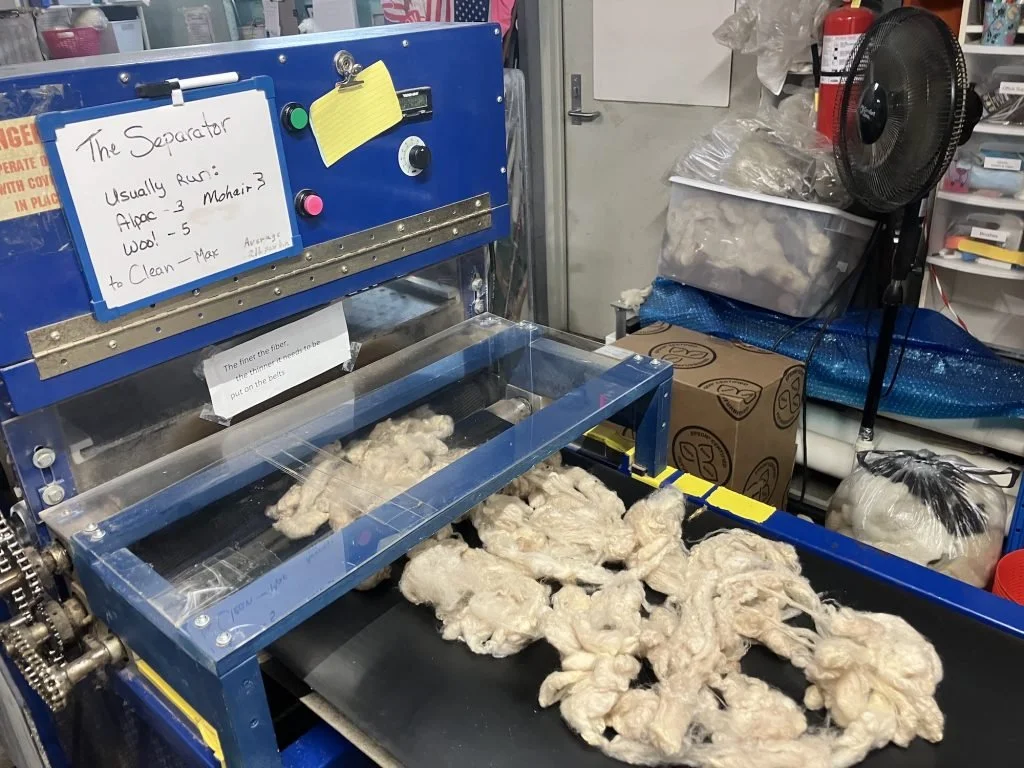

Tour of Shepherd’s Gate Mill from June 2024. Photo credit Courtney Lockemer.

Among the next steps set out by the survey are the goals of 1. establishing a phased approach to address multiple macroeconomic threats and 2. meeting with public and private sector groups to address challenges.

To learn more about our Producer Survey Results, please register for the Zoom presentation taking place on Jan 28th from 6-7pm. The Zoom recording will be available for those unable to attend the live presentation.